“THE DEVIL IS IN THE DETAILS…” Or so the famous saying goes. And when it comes to really understanding the various reports and events unfolding in the economy, it’s important to take a look at the details – not just the headlines. Here’s what you need to know.

On the inflation front, the Producer Price Index, which measures wholesale inflation, unexpectedly fell due to a drop in energy prices. While that seems like good news on the surface, keep in mind that next month’s number could climb higher again, as oil and natural gas have both been on a tear higher lately.

In housing news, Housing Starts and Building Permits both came in a bit below expectations, but this may be a sign that builders are exercising some caution – particularly in the face of the $8,000 tax credit for first time homebuyers that is presently set to expire on November 30th. Existing Home Sales came in better than expected – and a whopping 45% of those homes were sold to first time homebuyers – rushing to move in on that credit. Recent studies have shown that many who qualify for this tax credit aren’t even aware of it…so please let me know if you or someone you know needs more information – the clock is ticking!

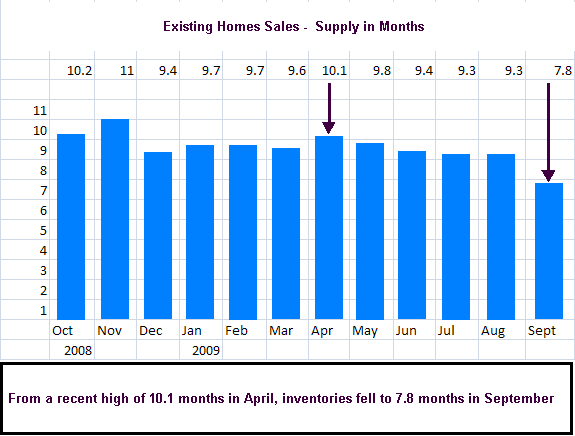

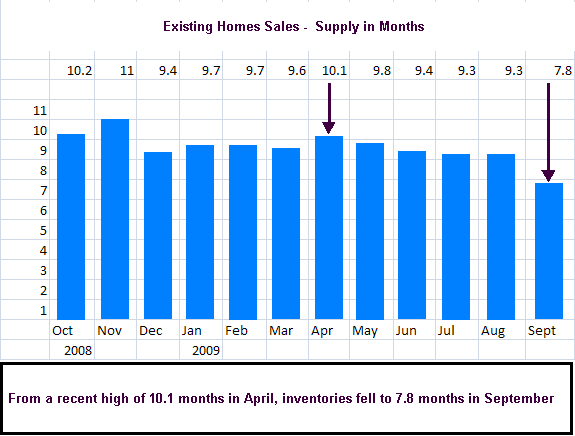

Additionally, the level of existing homes inventory shrunk to a 7.8 month supply, down from a recent high of 10.1 months in April.

———————–

Chart: Existing Home Sales (Supply in Months)

In other news, 3rd quarter earnings season continues, where companies report their status as of the end of September. While many companies are beating expectations, it’s important to realize that many of those companies achieved better earnings by cost cutting and layoffs, not from increased sales. This is a big disconnect between Wall Street and “Main Street”. Stocks are rocketing higher based on these “positive” reports, but the cost cutting and job cutting measures can only go so far…you can’t simultaneously grow the ranks of unemployment – and then grow your business, hoping for increased sales to those same people who are without jobs.

Last week’s Jobless Claims numbers seem to confirm this as Initial Jobless Claims rose more than expected. In addition, the number of individuals continuing to receive unemployment benefits fell to the lowest level since March, but this is likely the result of people’s unemployment benefits expiring, without them having been able to find jobs.

Also worth noting is the news that ratings agency Moody’s lead analyst, Steven Hess, said that the US needs to cut its deficit or it could lose its “AAA” rating in the next 3 to 4 years, which we have maintained since 1917! Think of all we’ve been through – two World Wars, the Depression, three Wall Street collapses and major terrorist attacks…yet our credit quality has maintained that AAA rating, allowing us to issue debt at the most favorable rates. Hess went on to say that if the US doesn’t “get the deficit down in the next 3-4 years to a sustainable level, then the rating will be in jeopardy.” And just like on a mortgage when the credit rating gets reduced, interest rates move higher. This will definitely be something we’ll keep an eye on in the months ahead.

After all the week’s action, Bonds and home loan rates ended the week slightly worse than where they began.